Cyfrowy Polsat Group closed Q2 with very good and stable results which are in line with its long-term strategy in both customer segments. The achieved, strong results exceed the average figures expected by stock exchange analysts. Acquisition of control over Netia in May paved way for the start of operational cooperation of the two companies, whereas strategic cooperation and purchase of a controlling stake in the Eleven Sports Network’s Polish operation support consistent development of the Group’s offer of premium sports programs. At the same time, sale of the offers which include the Polsat Sport Premium package, featuring UEFA Champions League and Europa League matches, has taken off and is offered as part of all Polsat Group services.

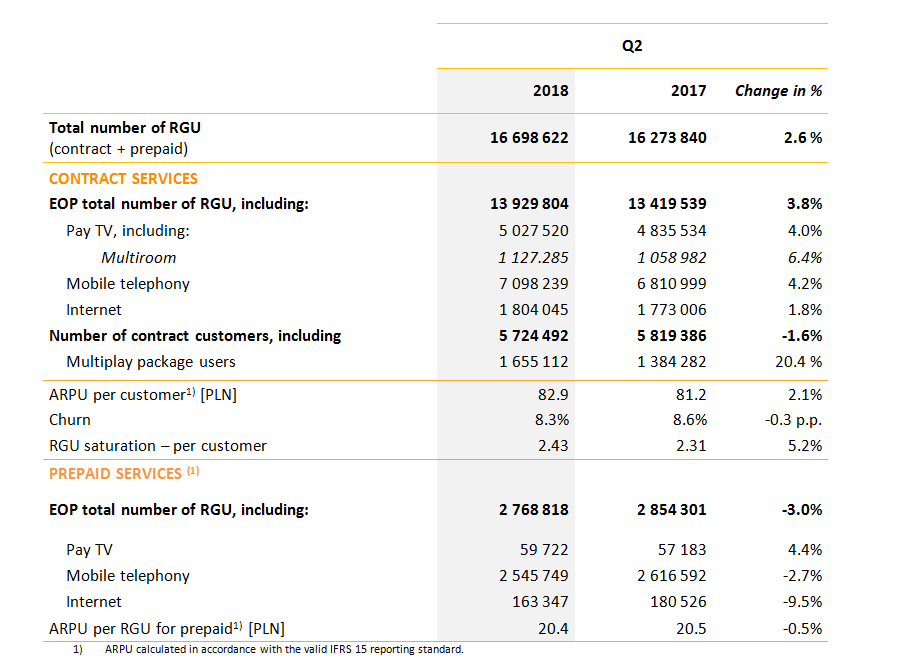

Major operating figures in Q1 2018

- Bundled offers are used by increasing numbers of customers thanks to the effective implementation of the multiplay strategy:

- Systematic growth of the number of multiplay service customers – up by 281 thousand (20%) y/y, to 1.66 million (which constitutes 28.9% of the contract customer base).

- The number of services (RGU’s) used by this group of customers increased to 4.94 million.

- The above led to reduction of the churn ratio to a very low level of 8.3% yearly.

- Regular growth of the number of contract services - up by 510 thousand yoy, reaching 13.9 million in total (contract services account for 83.4% of all provided services):

- Another quarter with growth of the number of mobile voice services – up by 287 thousand yoy, reaching 7.1 million in total. This development is the outcome of the favorable influence of the adopted multiplay strategy, good reception of Plus’s new simple tariffs that were launched this February as well as high sales in the B2B segment (m2m solutions).

- Thanks to good sales of basic packages and value-added services (Multiroom and paid OTT services), the total number of contract pay TV services increased by 192 thousand yoy and exceeded 5 million.

- Internet access customer base increased by 31 thousand yoy and now stands at 1.8 million. During the first half of this year retail customers of Cyfrowy Polsat and Plus transferred 448 PB of data.

- Stable base of over 5.7 million contract customers:

- RGU saturation increased by 5.2% yoy, with the average number of 2.43 services from the Group’s portfolio per customer.

- Average revenue per contract customer (ARPU), as calculated in accordance with the valid IFRS 15 accounting standard, increased by 2.1% and reached PLN 82.9 in spite of the negative impact of the Roam like at home regulation. The company expects that Q2 is the last quarter of negative impact of the new regulation on ARPU.

- Stable prepaid base of 2.8 million services reflects the actual user base of the prepaid service.

- High and stable ARPU from prepaid service, amounting PLN 20.4

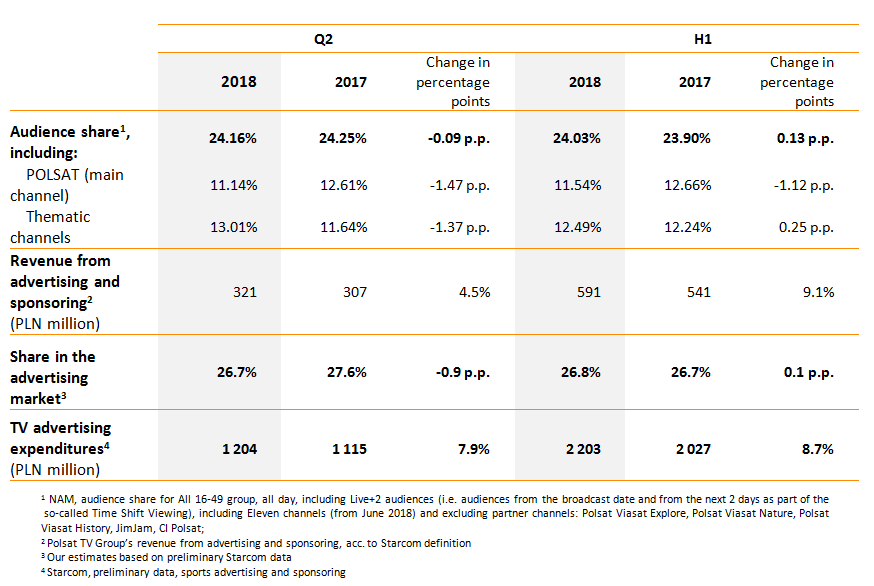

- Polsat Group’s TV channels continued to stay at the top in terms of audience share in the commercial viewer group, both in Q2 and during the whole first half of the year. In Q2 Polsat Group’s TV channels achieved audience share of 24.2% (11.2% for the main channel and 13% for theme channels) in spite of a temporary adverse impact of the coverage of the 2018 FIFA World Cup in Russia which was broadcasted via free-to-air channels of the public broadcaster. The overall audience share for the first half of 2018 was 24% (11.5% for the main channel and 12.5% for theme channels), which is in line with the Group’s long-term strategy.

- Revenue generated by Polsat TV Group from commercials and sponsoring increased by 4.5% yoy in Q2 and reached PLN 321 million, thanks to which the Group’s share in TV advertising market reached 26.7%. During the whole first half of the year revenue from TV advertising recorded growth by 9.1% and reached PLN 591 million, which gave market share of 26.8%.

“Our Group continues consistent pursuit of a development strategy in the area of multiplay offers, which is best demonstrated by nearly 1.7 million multiplay customers who already use about 5 million services. At the same time our business has been effectively supported by strategic acquisitions,” says Tobias Solorz, the CEO of Cyfrowy Polsat S.A. and Polkomtel Sp. z o.o. “Acquisition of control over Netia has enabled the companies from our Group to quickly embark on operational cooperation in key areas. Most of all Netia’s high speed fixed-line Internet access has been added to our smartDOM loyalty scheme which continues to enjoy unwavering interest while Netia’s products will be soon added to the offers of further points of sale operated by our Group. Netia’s TV offer has in turn been extended to include new Polsat TV channels and the package featuring UEFA Champions League and UEFA Europa League matches, with both companies gaining additional communication attributes. Another matter which is also important is the acquisition of a majority stake in Eleven Sports Network, a company who has broad access to broadcasting rights for numerous attractive sports events and operates four very dynamically developing TV channels on the Polish market. A development which is also very important is the introduction, to Cyfrowy Polsat, Plus and iPLA, of the offers which include UEFA Champions League and UEFA Europa League matches, along with the start of broadcasts from these tournaments last Tuesday.”

Operational figures for the segment of services provided to residential and business customers

“It has been yet another very successful period for us in the television. In the second quarter the audience results for Polsat Group channels were in line with our long-term strategy in spite of broadcasting by the public broadcaster of a sports event with very strong impact on the market, i.e. the FIFA World Cup Russia 2018. Similar and equally stable audience results were achieved by us during the entire first half of the year, during which our revenue from advertising and sponsoring, riding on the back of fast implementation of the synergies with the newly acquired TV channels, grew at even a slightly faster pace than the market which has been developing dynamically this year,” says Maciej Stec, a Management Board Member of Cyfrowy Polsat S.A. and Telewizja Polsat Sp. z o.o.

Operational figures for the segment of TV broadcasting and production

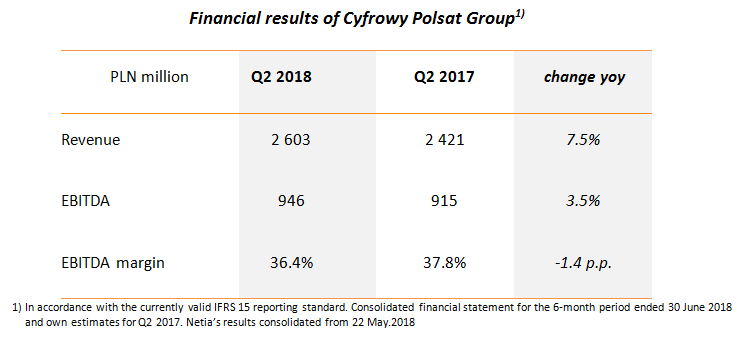

Major financial figures for Q2 2018

- The Group demonstrated strong financial performance (in accordance with the currently valid IFRS 15 reporting standard as well as while accounting for consolidation of Netia’s results starting from 22 May 2018; the historical data for 2017 is also presented in accordance with IFRSF 15):

Financial results of Cyfrowy Polsat Group1)

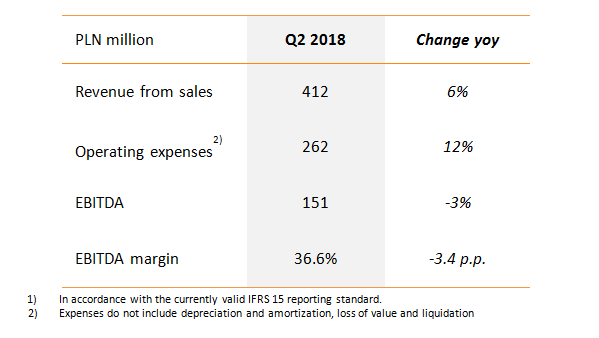

- Growing financial results of the segment of services provided to residential and business customers (as calculated in accordance with the currently valid IFRS 15 reporting standard and while accounting for the consolidation of Netia’s results):

- Very good results of the TV broadcasting and production segment (as calculated in accordance with the currently valid IFRS 15 reporting standard):

Financial results of the TV broadcasting and production segment1)

“It’s been yet another quarter of changes, since we have not only published our results in accordance with the new reporting standard, the IFRS 15, but from May 22 we have started consolidating the results of Netia. The performance of the whole Group is strong, healthy and exceeds the average figures from the analysts’ forecasts. Free cash flow remains high, which offers comfort in the pursuit of our complex business strategy and our investment plans, while at the same time enabling us to keep our debt under control,” says Katarzyna Ostap-Tomann, a Management Board Member responsible for finance at Cyfrowy Polsat S.A., Polkomtel Sp. z o.o., Telewizja Polsat Sp. z o.o. “As regards the segment of services provided to residential and business customers, the past quarter, as we stated earlier, was the fourth quarter in a row in which the results remained under distinct adverse influence of the Roam like at home regulation. The importance of this factor should decrease in the future. EBITDA generated by the TV broadcasting and production segment has been stable in turn, in spite of the passing pressure which resulted from the 2018 FIFA World Cup Russia tournament being broadcasted via the public broadcaster’s free to air channels.