2024

Without dividend (allocated to reserve capital)*

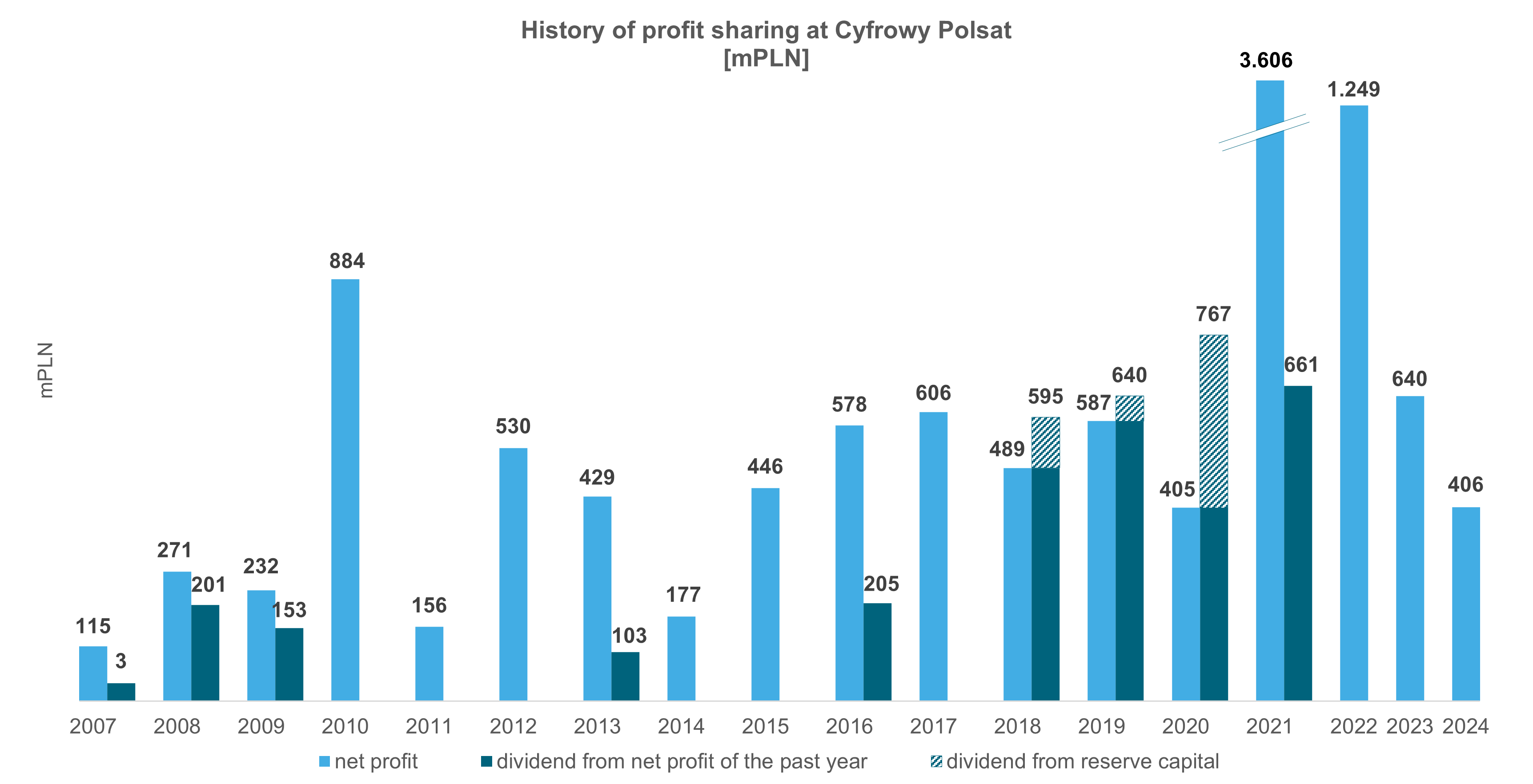

| 2024 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 405,839,754.30 | 0 | 0 | - | - |

*The justification for the resolution of the AGM held on June 26, 2025 - Taking into account the current financial situation and liquidity of Cyfrowy Polsat S.A. Capital Group and existing and future liabilities, in the opinion of the Management Board it is recommended to allocate the Company's net profit for the financial year 2024 amounting to PLN 405,839,754.30 in full to the reserve capital.

In the above recommendation, the Management Board took into account the level of the Company’s net debt to EBITDA LTM ratio (excluding project financing), which for the last reported period exceeded the level of 3.5x allowing for dividend payout. The elevated level of the net debt to EBITDA LTM ratio is due to continued high interest rates throughout 2024 and, consequently, high debt service costs and inflationary pressure.

In parallel, as part of its Strategy 2023+ the Company is consistently pursuing strategic investments in the area of renewable energy sources, aimed at continuing the development of the Company's capital group over the long term in accordance with the overarching strategic objective of sustainably growing the Company's value for its shareholders.

2023

Without dividend (allocated to reserve capital)*

| 2023 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 639,553,459.05 | 0 | 0 | - | - |

*The justification for the resolution of the AGM held on June 29, 2024 - In the opinion of the Management Board of the Company, the proposed allocation of profit in its entirety to reserve capital and the lack of a recommendation for dividend payment is dictated by the ongoing capital-intensive, strategic investments implemented by the Company as part of its Strategy 2023+, aimed at continuing the development of the Company's capital group over the long term in accordance with the overarching strategic objective of sustainably growing the Company's value for its shareholders. In particular, the funds retained by the Company will be used for the timely implementation of the currently ongoing green energy projects, which, among others, include the construction of wind farms. As a result of the implementation of the aforementioned projects, the Company's capital group will reach an installed capacity in renewable energy sources in 2026, which will enable the production of up to 2 TWh of clean energy per year. According to the Company's estimates, the execution of strategic assumptions will translate into incremental recurring EBITDA at the consolidated level of ca. PLN 500-600 million per year. At the same time, in deciding not to pay a dividend, the Management Board took into account the Company's net debt ratio, which remains at an elevated level due to, among others, the financing of strategic investments, as well as the unfavorable macroeconomic environment, in particular high inflationary pressure and persistently high interest rates translating into high debt service costs for the Company.

2022

Without dividend (allocated to reserve capital)*

| 2022 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 1,248,575,921.33 | 0 | 0 | - | - |

*The justification for the resolution of the AGM held on June 29, 2023 - In the opinion of the Management Board of the Company, the allocation of profit in its entirety to reserve capital and the lack of recommendation for dividend payment is dictated by the ongoing, capital-intensive, strategic investments implemented by the Company as part of Strategy 2023+, aimed at continuing the development of the Company's capital group over the long term in accordance with the overriding strategic objective of sustainably increasing the Company's value for its shareholders. At the same time, the Board of Directors took into account the Company's net debt ratio, which remains at an elevated level as a result of the financing of strategic investments, as well as the unfavorable macroeconomic environment, in particular, high inflationary pressures and persistently high interest rates translating into rising debt service costs for the Company. At the same time, the Company's Management Board maintains the dividend policy adopted on December 20, 2021.

2021

Paid

| 2021 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

PLN | 3,605,855,418.23 | 660,844,237.20 | 1.20 | 20 September 2022 | 15 December 2022 |

2020

Paid

| 2020 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

PLN | 404,982,013.92 | 767,455,219.201 | 1.20 | 15 September 2021 | 28 September 2021 - 1st tranche 10 December 2021 - 2nd tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 362,473,205.28 from the reserve capital created from profits earned in previous years.

2019

Paid

| 2019 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

PLN | 586,802,125.73 | 639,546,016.001 | 1.00 | 15 October 2020 | 22 October 2020 - 1st tranche 11 January 2021 - 2nd tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 52,743,890.27 from the reserve capital created from profits earned in previous years.

2018

Paid

| 2018 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

PLN | 488,520,113.73 | 594,777,794.881 | 0.93 | 1 July 2019 | 3 July 2019 - 1st tranche 1 October 2019 - 2nd tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 106,257,681.15 from the reserve capital created from profits earned in previous years.

2017

Without dividend (allocated to reserve capital)*

| 2017 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 605,963,020.33 | 0 | 0 | - | - |

2016

Paid

| 2016 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 577.955.495,16 | 204,654,725.12 | 0.32 | 20 July 2017 | 3 August 2017 |

2015

Without dividend (allocated to reserve capital)*

| 2015 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 446,146,891.55 | 0 | 0 | - | - |

2014

Without dividend (allocated to reserve capital)*

| 2014 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 177,213,590.79 | 0 | 0 | - | - |

2013

Paid

| 2013 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 429,012,674.99 | 102,859,516.76 | 0.26 | 22 May 2014 | 6 June 2014 |

2012

Without dividend (allocated to reserve capital)*

| 2012 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 529,837,249.45 | 0 | 0 | - | - |

2011

Without dividend (allocated to reserve capital and to cover losses from previous years)*

| 2011 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 156,092,789.88 | 0 | 0 | - | - |

2010

Without dividend (allocated to reserve capital)*

| 2010 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 884,165,232.13 | 0 | 0 | - | - |

2009

Paid

| 2009 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 232,040,914.16 | 152,945,250.00 | 0.57 | 19 July 2010 | ||

| I installment | 101,963,500.00 | 0.38 | 19 July 2010 | 11 August 2010 | |

| II installment | 50,981,750.00 | 0.19 | 19 July 2010 | 17 November 2010 |

2008

Paid

| 2008 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 271,277,066.74 | 201,243,750.00 | 0.75 | 1 June 2009 | ||

| I installment | 134,162,500.00 | 0.50 | 1 June 2009 | 16 June 2009 | |

| II installment | 67,081,250.00 | 0.25 | 1 June 2009 | 21 October 2009 |

2007

Paid

| 2007 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 115,038,239.62 | 37,565,500.00 | 0.14 | 18 July 2008 | 5 August 2008 |