Cyfrowy Polsat Group ended Q2 with very good and stable operating results in both segments of its business while demonstrating very good financial performance and, once again, record-low churn. The Group’s offer of sports programs, which is consistently being developed, has been enriched to include two new TV channels, i.e. Canal+ Sport 3 and Canal+ Sport 4, broadcasting all matches of PKO Ekstraklasa Polish premiership. Cyfrowy Polsat has also introduced a new breakthrough service – the OTT web TV which can be accessed via Internet connection from any ISP, with flexible choice of program bundles, and without any recurrent access fees. Moody’s, in turn, raised the Group’s corporate rating to Ba1.

Major operating figures for Q2 2019

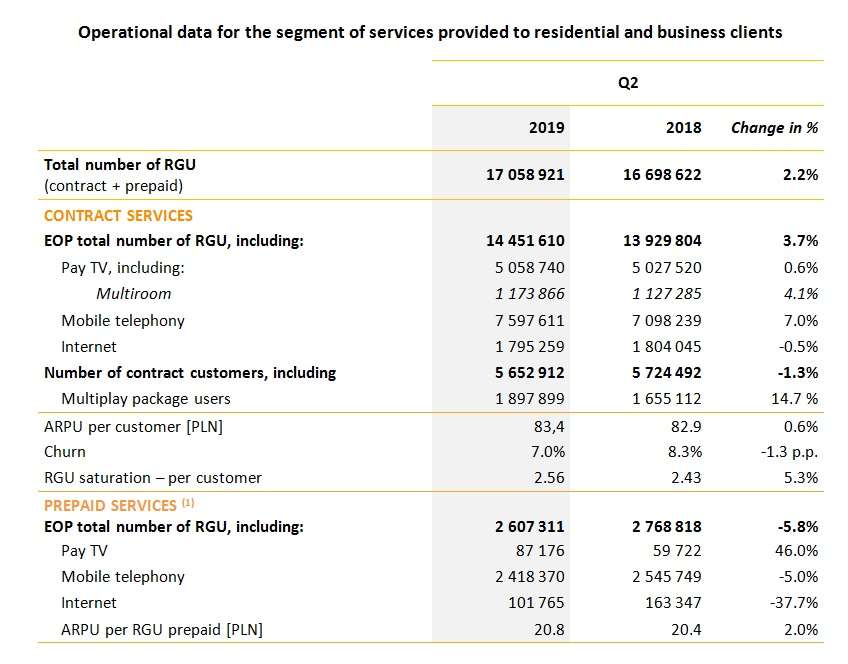

- Already one out of three of the Group’s customers uses the multiplay offer:

- Stable growth of multiplay customers – up by 243 thousand (15%) YoY, to the level of 1.9 million, or 34% of our contract customer base.

- The number of services (RGU’s) used by this group of customers increased to 5.71 million.

- Record churn reduction, by 1.3 p.p. YoY, to as little as only 7% annually.

- Strong growth of the number of contract services – up by 522 thousand YoY, to 14.45 million:

- Substantial growth of mobile services – by 499 thousand YoY, to 7.6 million thanks to the favorable influence of our multiplay strategy, sustained interest of customers in Plus’s simple tariffs which were launched in February 2018, and the high sales to B2B segment (m2m solutions).

- Thanks to the sustained demand for Multiroom services, and the successfully selling paid OTT services, the total number of pay TV contract services increased by 31 thousand YoY and is at 5.1 million now.

- High, stable base of Internet access services at 1.8 million. During Q2 2019 retail customers of Cyfrowy Polsat and Plus network transferred ca. 267 PB of data, while during the entire first half of 2019 data usage was 530 PB.. Nearly 100% of Poles live within the coverage footprint of the Group’s LTE network, with LTE Advanced coverage extending over an area inhabited 73% of the country’s population.

- Stable base of 5.7 million contract customers:

- Growth of saturation of services per customer – up by 5.3% YoY, with each customer using 2.56 of the Group’s services on the average.

- Average revenue per contract customer (ARPU) increased by 0.6% YoY and reached PLN 83.4.

- Stable prepaid base of 2.6 million, with high and growing ARPU which increased by 2% YoY, to PLN 20.8.

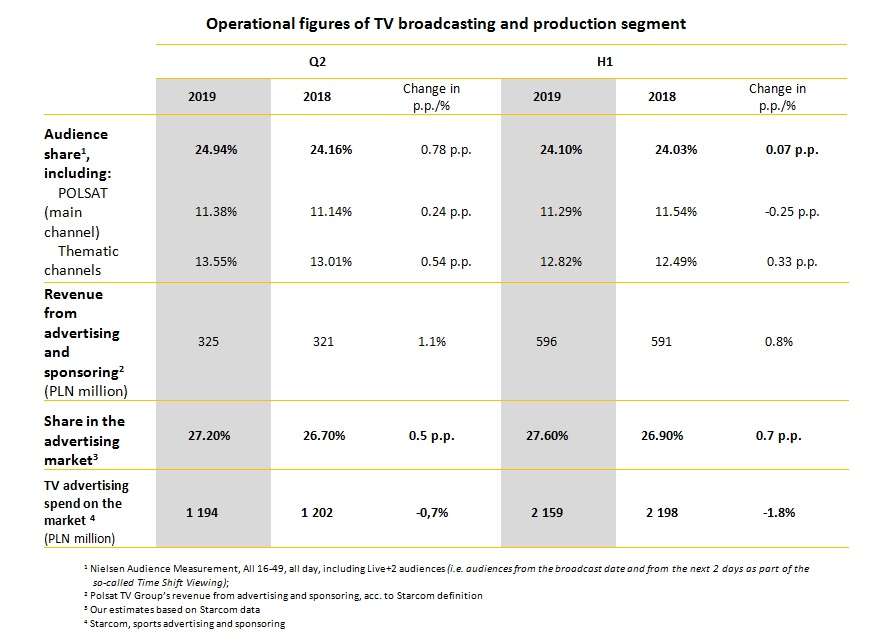

- Polsat TV’s channels ranked at top spots in audience shares in the commercial viewer group, achieving 24.9% (11.4% for the main channel and 13.6% for theme channels in Q2, and respectively 24.1% (11.3% for the main channel and 12.8% for theme channels) during the first six months of the year.

- Polsat TV Group’s revenue from TV advertising and sponsoring increased both in Q2 and in H1: up by 1.1% YoY, to PLN 325 million, pushing up, as a result, the Group’s share in the TV advertising market to the level of 27.2% in Q2 (with a simultaneous decline of the TV advertising market’s value by 0.7%) and up by 0.8% YoY, to PLN 596 million in H1, thanks to which the Group’s share in the TV advertising market increased to 27.6% in H1 (the whole TV advertising market’s value decreased by 1.8% meanwhile).

“Consistent pursuit of our multiplay strategy has once again given us very good results. The number of contract services which we provide to our customers increased by half a million, 1.9 million of our customers use multiplay offers while churn ratio decreased once again to a record-low level of only 7% annually,” says Mirosław Błaszczyk, the CEO of Cyfrowy Polsat S.A. and Polkomtel Sp. z o.o. “We have expanded our premium sports offer, while offering access maximum numbers of tournaments, sports and live coverage from major events. Thanks to the cooperation that we have established with Canal+, apart from being able to follow the UEFA Champions League and the UEFA Europa League matches, our viewers have also gained access, via the new Canal+ Sport 3 and Canal+ Sport 4 channels, to all the matches played in the Polish PKO Ekstraklasa football premiership.”

“Just as we have been announcing, soon after introducing cable TV in IPTV technology we presented the next novelty, i.e. OTT web TV. It is yet another step on the path to fulfillment of our strategic idea: ”TV – For everyone. Everywhere. Internet – For everyone. Everywhere. Telephone – For everyone. Everywhere”. The new service enables reception of TV channels via Internet access service from any provider, with a flexible programming offer where program bundles can be freely switched on right from the set-top box, without the necessity of entering into any long-term commitments,” adds Maciej Stec, Vice President of the Management Board for Strategy at Cyfrowy Polsat S.A. and Polkomtel Sp. z o.o.

"Both, Q2 and the whole first half of the year were very successful for Polsat TV. The main channel and the theme channels were at top spots in terms of audience shares in the commercial viewer group, in line with our long-term strategy. Our revenue from TV advertising and sponsoring grew by 1% in a situation of decline of the TV advertising market during the first half of the year,” says Stanisław Janowski, the CEO of Telewizja Polsat Sp. z o.o. “We trust that the second half of the year will bring even better performance and that is why we are sustaining our expectations of continued single-digit market growth during the whole year. At the same time, as part of the autumn programming offer of Polsat TV, we have prepared, for our viewers, some new interesting formats and further seasons of our most popular shows,” adds Janowski

Major financial figures for Q2 2019

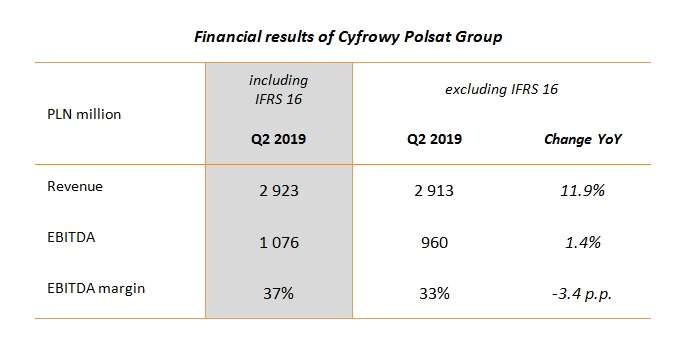

- The Group demonstrated stable financial performance in Q2 2019 (including IFRS 16):

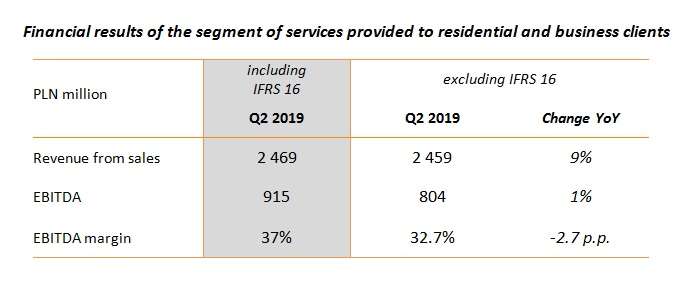

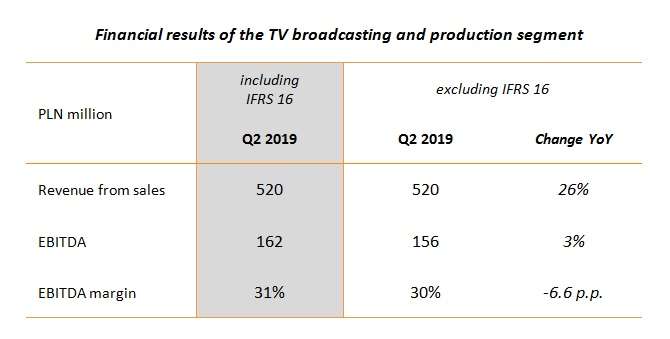

“We ended Q2 with very good and stable financial results which exceeded the analysts’ forecasts and reflected the healthy condition of our Group. Revenue was PLN 2.9 bn, EBITDA exceeded PLN 1 bn, while net profit amounted PLN 270 mn,” says Katarzyna Ostap-Tomann, the CFO of Cyfrowy Polsat S.A. and Polkomtel Sp. z o.o. “The segment of the services provided to residential and business customers grew not only due to consolidation of Netia’s figures but also organically, thanks to the growth of revenue from sale of equipment and wholesale operations. The results of the TV broadcasting and production segment grew thanks to, among others, the extension of Polsat’s offer by adding Eleven Sports and Polsat Sport Premium packages which are offered to cable and satellite TV operators,” adds Katarzyna Ostap-Tomann.

“Free cash flow is in line with our forecasts and remains at a high level of nearly PLN 1.4 bn for the 12-month period. While taking care of regular debt reduction, during the first half of the year we repaid more than PLN 850 million of loans and we also finalized the process of very good refinancing of our bands. Stable financial results allow us to reconcile the comfort of our creditors with solid compensation for our shareholders who will be paid nearly PLN 600 million in dividend for 2018, with the first tranche already having been paid on July 3,” sums up Katarzyna Ostap-Tomann. “The fact that following change of our dividend policy to a more generous one Moody’s decided to raise our rating to Ba1 demonstrates the stability and the credibility of our business, and it is the confirmation of maintenance of the balance between debt reduction and profit sharing, as expected by our shareholders, lenders and the market,” adds Ms. Ostap Tomann.