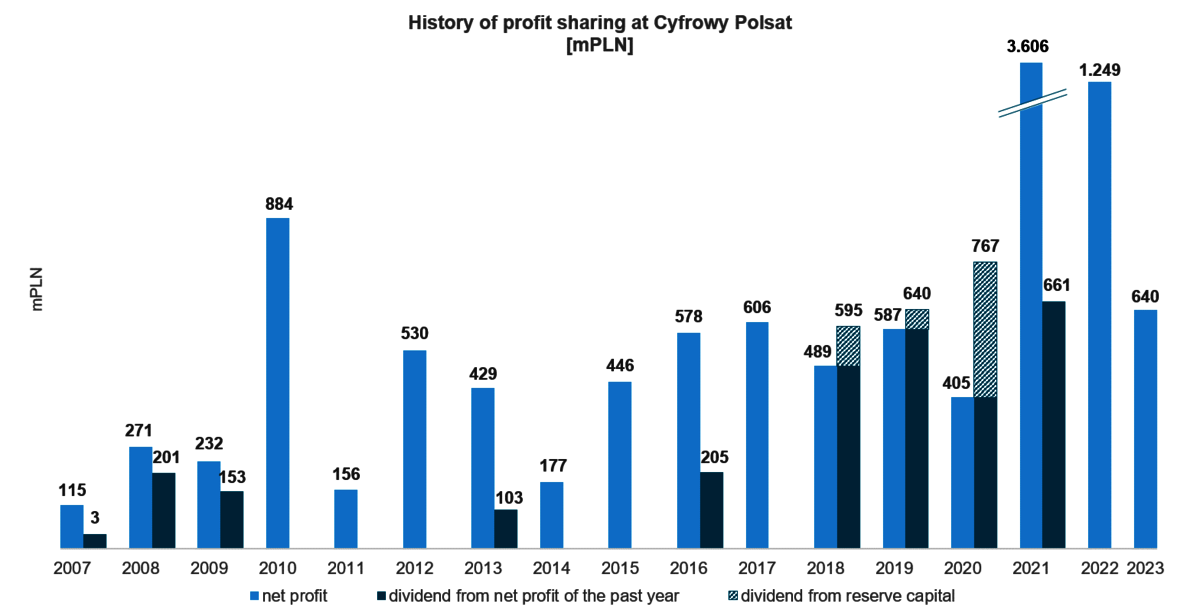

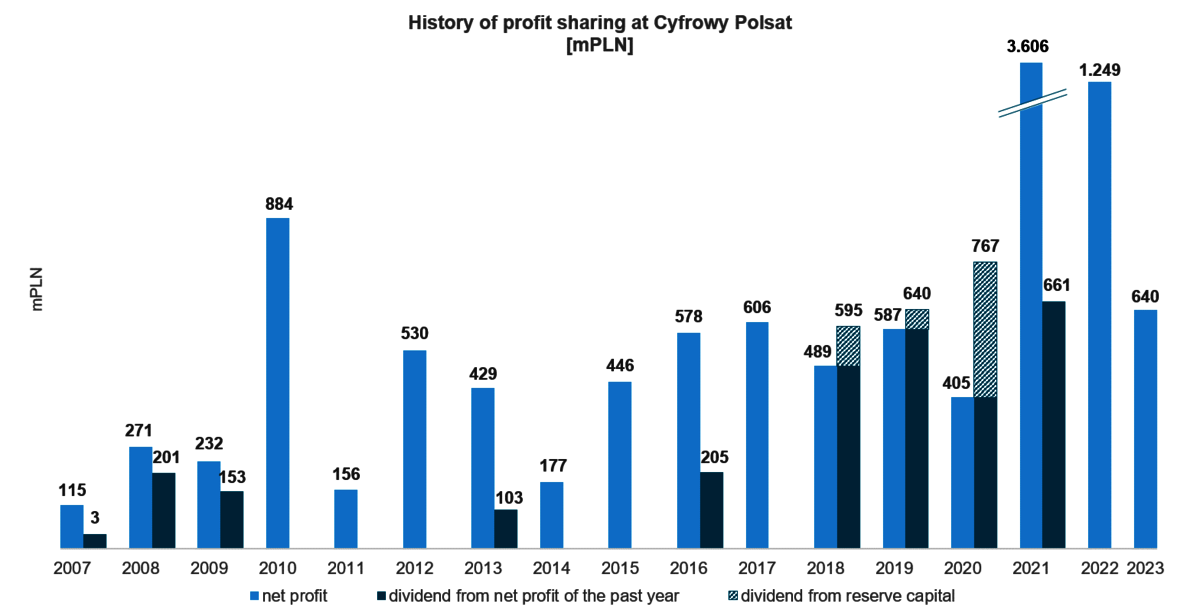

2023

Without dividend (allocated to reserve capital)*

*The justification for the resolution of the AGM held on June 29, 2024 - In the opinion of the Management Board of the Company, the proposed allocation of profit in its entirety to reserve capital and the lack of a recommendation for dividend payment is dictated by the ongoing capital-intensive, strategic investments implemented by the Company as part of its Strategy 2023+, aimed at continuing the development of the Company's capital group over the long term in accordance with the overarching strategic objective of sustainably growing the Company's value for its shareholders. In particular, the funds retained by the Company will be used for the timely implementation of the currently ongoing green energy projects, which, among others, include the construction of wind farms. As a result of the implementation of the aforementioned projects, the Company's capital group will reach an installed capacity in renewable energy sources in 2026, which will enable the production of up to 2 TWh of clean energy per year. According to the Company's estimates, the execution of strategic assumptions will translate into incremental recurring EBITDA at the consolidated level of ca. PLN 500-600 million per year. At the same time, in deciding not to pay a dividend, the Management Board took into account the Company's net debt ratio, which remains at an elevated level due to, among others, the financing of strategic investments, as well as the unfavorable macroeconomic environment, in particular high inflationary pressure and persistently high interest rates translating into high debt service costs for the Company.

2022

Without dividend (allocated to reserve capital)*

*The justification for the resolution of the AGM held on June 29, 2023 - In the opinion of the Management Board of the Company, the allocation of profit in its entirety to reserve capital and the lack of recommendation for dividend payment is dictated by the ongoing, capital-intensive, strategic investments implemented by the Company as part of Strategy 2023+, aimed at continuing the development of the Company's capital group over the long term in accordance with the overriding strategic objective of sustainably increasing the Company's value for its shareholders. At the same time, the Board of Directors took into account the Company's net debt ratio, which remains at an elevated level as a result of the financing of strategic investments, as well as the unfavorable macroeconomic environment, in particular, high inflationary pressures and persistently high interest rates translating into rising debt service costs for the Company. At the same time, the Company's Management Board maintains the dividend policy adopted on December 20, 2021.

2021

Paid

2020

Paid

| 2020 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

|

PLN

|

404,982,013.92

|

767,455,219.201

|

1.20 |

15 September 2021 |

28 September 2021 - 1st tranche

10 December 2021 - 2nd tranche

|

|---|

[1] In accordance with the resolution of the General Meeting, includes PLN 362,473,205.28 from the reserve capital created from profits earned in previous years.

2019

Paid

| 2019 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

|

PLN

|

586,802,125.73 |

639,546,016.001 |

1.00 |

15 October 2020 |

22 October 2020 - 1st tranche

11 January 2021 - 2nd tranche

|

|---|

[1] In accordance with the resolution of the General Meeting, includes PLN 52,743,890.27 from the reserve capital created from profits earned in previous years.

2018

Paid

| 2018 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

|

PLN

|

488,520,113.73 |

594,777,794.881 |

0.93 |

1 July 2019 |

3 July 2019 - 1st tranche

1 October 2019 - 2nd tranche

|

|---|

[1] In accordance with the resolution of the General Meeting, includes PLN 106,257,681.15 from the reserve capital created from profits earned in previous years.

2017

Without dividend (allocated to reserve capital)*

*The justification for the resolution of the AGM held on June 28, 2018 - Taking into consideration the strategic investments made by the Company and some of its subsidiaries in 2017 and 2018, which ensure the continuation of the development of the capital group of the Company (the “Group”) in the long term in accordance with its key strategic goal to sustainably grow the Company’s value for its shareholders as well as bearing in mind a relatively high level of the Group‘s indebtedness, the Management Board of the Company decided not to recommend a dividend payment from the profit for 2017. In the opinion of the Management Board, this will allow to reduce the indebtedness level of the Group, in line with the adopted strategic assumptions, and with the goal of the capital resources management policy in particular, which is to reduce in a possibly short time the total net debt ratio for the Group (net debt to EBITDA) below 1.75x. In parallel, the Management Board of the Company confirms the dividend policy adopted on November 8, 2016. Taking into account the above, the Management Board, acting pursuant to article 382 § 3 of the Commercial Companies Code and article 19 item 2(a) of the Company’s Articles of Association, recommends to allocate the entire profit earned by the Company in the financial year ended December 31, 2017, amounting to PLN 605,963,020.33 (say: six hundred five million nine hundred sixty three thousand twenty zlotys and thirty three grosze) to the reserve capital.

2016

Paid

2015

Without dividend (allocated to reserve capital)*

*The justification for the resolution of the AGM held on June 29, 2016 - Considering the relatively high level of the current indebtedness of the capital group of the Company, the Management Board of the Company consistently aims for its reduction. In accordance with the adopted assumptions, the strategic goal of the capital resources management policy is the reduction of the total net indebtedness ratio of the Company's capital group, i.e. net debt to EBITDA, below the level of 1.75 as fast as possible. The rapid achievement of the goal would allow for a revision of the dividend policy and the return to regular payouts of part of the generated profit starting from the year 2017.

2014

Without dividend (allocated to reserve capital)*

*The justification for the resolution of the AGM held on April 2, 2015 - In accordance with the dividend policy of the Company, adopted on January 22, 2014, of which the Company informed in current report no. 7/2014 dated January 23, 2014, the Management Board of the Company shall submit a proposal to the General Meeting for the distribution of dividends provided that the total indebtedness ratio of the Company's capital group, i.e. net debt to EBITDA as at the end of the financial year to which the profit distribution refers is less than 2.5x. Bearing in mind the existing obligation of the Company’s capital group, the aim of the Management Board of the Company is to reduce the level of indebtedness as fast as possible in order to achieve the level of the net debt/EBITDA ratio anticipated in the dividend policy in the shortest term possible.

2013

Paid

| 2013 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| PLN |

429,012,674.99 |

102,859,516.76 |

0.26 |

22 May 2014 |

6 June 2014 |

|---|

2012

Without dividend (allocated to reserve capital)*

| 2012 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| PLN |

529,837,249.45 |

0 |

0 |

- |

- |

|---|

*The justification for the resolution of the AGM held on June 11, 2013 - The Management Board's recommendation concerning the distribution of the profit is justified by one of the strategic objectives of the Company, that is lowering the Company's indebtedness, arisen due to the acquisition of Telewizja Polsat by the Company, in the shortest possible term. According to the loan agreements, consistent reduction of the level of the Company's debt ahead of schedule, and thereby reduction of the net debt/EBITDA ratio, will result in both reduction of nominal principal payments and interest charges, which will have a positive impact on the Company's financial standing in future periods.

2011

Without dividend (allocated to reserve capital and to cover losses from previous years)*

| 2011 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| PLN |

156,092,789.88 |

0 |

0 |

- |

- |

|---|

*The justification for the resolution of the AGM held on June 5, 2012 - The decision of the Management Board concerning the distribution of the profit was based on one of the strategic objectives of the Company, which is lowering the Company's indebtedness, arisen due to the acquisition of Telewizja Polsat by the Company, in the shortest possible term. Consistent reduction of the level of the Company's debt and thereby reduction of the net debt/EBITDA ratio, according to the loan agreements will reduce interest charges and thus will have a positive impact on the Company's financial standing in future periods.

2010

Without dividend (allocated to reserve capital)*

| 2010 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| PLN |

884,165,232.13 |

0 |

0 |

- |

- |

|---|

*The justification for the resolution of the AGM held on May 19, 2011 - The Management Board justifies its recommendation by the need of future service of the debt incurred by the Company to purchase 100% shares of Telewizja Polsat S.A. The reduction of indebtedness of the Company, planned by the Management Board, and thereby reduction of the net debt/EBITDA ratio, will reduce interest charges arising from the signed loan agreements, and thus will have a positive impact on the Company's financial standing.

2009

Paid

| 2009 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| |

232,040,914.16 |

152,945,250.00 |

0.57 |

19 July 2010 |

|

|---|

| I installment |

|

101,963,500.00 |

0.38 |

19 July 2010 |

11 August 2010 |

|---|

| II installment |

|

50,981,750.00 |

0.19 |

19 July 2010 |

17 November 2010 |

|---|

2008

Paid

| 2008 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| |

271,277,066.74 |

201,243,750.00 |

0.75 |

1 June 2009 |

|

|---|

| I installment |

|

134,162,500.00 |

0.50 |

1 June 2009 |

16 June 2009 |

|---|

| II installment |

|

67,081,250.00 |

0.25 |

1 June 2009 |

21 October 2009 |

|---|

2007

Paid

| 2007 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|

| |

115,038,239.62 |

37,565,500.00 |

0.14 |

18 July 2008 |

5 August 2008 |